How much deposit do I need to buy a property in London

Evertise

03 Nov 2021, 15:54 GMT+10

Purchasing a property is a huge responsibility that involves physical and mental efforts for a prolonged time. The idea of owning a home might seem exciting and fretful at the same time. From beginning to looking for the perfect home in a large city to dealing with all the paperwork, it can be tricky with where to start. Property buyers should check whether they are eligible for monthly repayments of mortgage loans to avoid financial struggles in the later phase. First-time buyers have plenty of offers that can be availed from mortgage lenders.

The favourable part of being involved in a property purchase is taking the help of local estate agents who will guide and assist the buyers with the entire process. The amount of money one needs to put down for a house will ultimately depend on certain factors like the annual income, credit scores and cost of the property. People need to keep a constant track of Notting Hill property prices and its surrounding neighbourhoods to plan their finances in advance. A good rule of thumb is that the buyer should spend no more than one-third of their annual income on mortgage payments.

ANALYZING THE COST OF LIVING

Living in London is not an easy task at hand with all the expenses to handle regularly. Property prices in London differ with location, property type and size of the household. The cost of utilities, groceries, commuting etc., should be kept in mind to manage them efficiently. When a person is planning to purchase a property, there are additional costs to oversee in the long term. The mortgage deals and loan repayments come with a hefty price, and it requires the proper allocation of finances. Similarly, the inclusion of council taxes and other property taxes play a significant role and buyers should make sure that they are eligible and capable enough to handle these major financial situations.

INITIAL DEPOSITS REQUIRED

Getting a mortgage loan is a lengthy process and might take from a few weeks to months to get the application approved by the mortgage lender. Many lenders provide 95% LTV (loan-to-value) for buyers. It is always better to have higher deposit rates to get the best deals from lenders. There are many mortgage and deposit calculators available online through which people can determine their upfront costs based on location, income, interest and more. The usual deposit rates are 10% of the total cost of the property. First-time buyers will have to pay a 15% initial deposit to get their loan sanctioned on time from the lenders. With the increasing number of people investing in properties lately, a new government-backed mortgage scheme is introduced for buyers who are ready to proceed with a 5% initial deposit.

PREPARING IN ADVANCE

Buyers need to be aware of the enormous sum of money involved in the entire process. Not many people get to know this in the primary stage and struggle to arrange their finances midway or at the last minute of the loan procedure. Getting the initial deposit amount ready is where most people face difficulty, which can be avoided if the buyers are well prepared for this situation. It is always advisable for buyers to start allocating and saving up for their deposit and other costs involved in the property buying process.

The initial deposit percentage differs with every lender. Calculating the property's total cost and the mortgage percentage will help the buyers know more about how much they will have to pay for the initial deposit. Large deposits also reduce the risk factors associated and increase the chances of acquiring higher LTV at the lowest interest rates from mortgage lenders. For those looking to buy a home with an interest rate over 5%, then it is best to have at least 20% saved up for the deposit amount. Most lenders demand deposits from 5% to 10% of the total property value. Likewise, the deposit range for first-timers is about 15% to 20%.

SAVING UP AND OTHER ALTERNATIVES

The thought of saving a lump sum separately for the initial deposit is a bit exhilarating with other expenses to handle simultaneously. However, there are many ways in which people can start saving money for their homes.

Fix a budget for the property and analyze the expenses to save up accordingly.

Maintain low credit scores to find the best lenders and great mortgage deals.

Partner up with another family member for a shared partnership to get maximum LTV and with the least interest rates.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of New Orleans Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to New Orleans Sun.

More InformationBusiness

SectionEngine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...

Microsoft trims jobs to manage soaring AI infrastructure costs

REDMOND, Washington: Microsoft is the latest tech giant to announce significant job cuts, as the financial strain of building next-generation...

Stocks worldwide struggle to make ground Friday with Wall Street closed

LONDON UK - U.S. stock markets were closed on Friday for Independence Day. Global Forex Markets Wrap Up Friday with Greeback Comeback...

Nvidia briefly tops Apple’s record in AI-fueled stock rally

SANTA CLARA, California: Nvidia came within a whisker of making financial history on July 3, briefly surpassing Apple's all-time market...

ICE raids leave crops rotting in California, farmers fear collapse

SACRAMENTO, California: California's multibillion-dollar farms are facing a growing crisis—not from drought or pests, but from a sudden...

Trump signals progress on India Trade, criticizes Japan stance

WASHINGTON, D.C.: President Donald Trump says the United States could soon reach a trade deal with India. He believes this deal would...

International

SectionTragedy in Spain: Diogo Jota and his brother die in car accident

MADRID, Spain: Liverpool footballer Diogo Jota and his younger brother, André Silva, have died in a car accident in Spain. Spanish...

Early heatwave grips Europe, leaving 8 dead and nations on alert

LONDON, U.K.: An unrelenting heatwave sweeping across Europe has pushed early summer temperatures to historic highs, triggering deadly...

U.S. military, China, Russia in Space race

President Donald Trump's plans to build a space-based Golden Dome missile defense shield have drawn immediate criticism from China,...

Trump wins $16 million settlement from Paramount over CBS Harris edit

NEW YORK CITY, New York: Paramount has agreed to pay US$16 million to settle a lawsuit brought by U.S. President Donald Trump over...

British PM faces major party revolt over welfare reforms

LONDON, U.K.: British Prime Minister Keir Starmer won a vote in Parliament this week to move ahead with changes to the country's welfare...

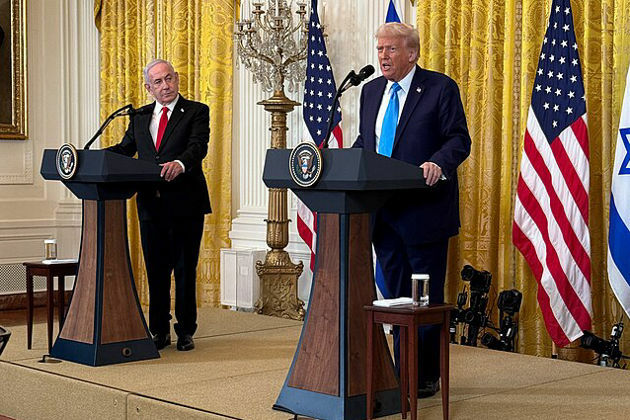

White House meeting between Trump, Netanyahu on July 7

WASHINGTON, D.C.: President Donald Trump will meet Israeli Prime Minister Benjamin Netanyahu at the White House on Monday. President...