Startup investing trends for 2023: where to allocate your capital

7Newswire

12 Oct 2023, 18:10 GMT+10

As we look towards the future of startup investing, it is clear that many exciting trends are on the horizon. The year 2023 promises to be pivotal for the world of startups, with new advancements in technology and consumer behavior impacting investment strategies. This article will explore the trends expected to shape the landscape of startup investing in 2023. From the rise of artificial intelligence to the increasing importance of sustainability, these trends can significantly impact investors and startups. So, let's dive into these trends and gain valuable insights to help us navigate startup investing.

The rise of Artificial Intelligence (AI)

Artificial intelligence has been a hot topic in recent years, and its impact on startup investing is only set to increase in 2023. With the rise of AI-powered technologies and applications, investors are increasingly looking toward companies that harness the power of AI to drive growth and innovation.

One area where AI is already making waves is in the field of predictive analytics. Startups use AI to analyze large amounts of data and accurately predict consumer behavior, market trends, and more. It not only helps startups make more informed decisions but also attracts investors who are looking for companies with a competitive advantage.

However, while the rise of AI brings many exciting possibilities for startup investing, some challenges need to be addressed. One such challenge is the ethical implications of AI, specifically related to data privacy. As startups rely on large amounts of user data to power their AI applications, investors must ensure that these companies take the necessary measures to protect user information, which will benefit the users and safeguard the company's reputation and, ultimately, its valuation.

The importance of diversity and inclusivity in startup investing

Diversity and inclusivity have been crucial topics in many industries, and the world of startup investing is no exception. In 2023, we can expect to see a greater emphasis on diversity and inclusivity from investors and startups.

Research has shown that diverse teams are more innovative and perform better financially. Therefore, investors are increasingly looking for startups with diverse teams and leadership. It signals a company's commitment to diversity and indicates a more well-rounded approach to decision-making.

Inclusivity is gaining traction in the startup world as well. Investors are keen to support these initiatives as more companies focus on creating products and services catering to various demographics. It opens up new markets for startups and helps them build a loyal customer base.

However, diversity and inclusivity should not be seen as just a trend in startup investing but as a necessary step towards creating an equitable society. Investors can play a crucial role in promoting these values by actively seeking and supporting diverse startups.

The impact of sustainability on startup investing

The importance of sustainability is growing, and investors are taking notice. In 2023, we can expect to see a shift towards sustainable investing, where investors look for companies prioritizing environmental and social responsibility.

This trend is driven by consumer demand for eco-friendly products and services. Startups that integrate sustainability into their business models not only attract environmentally conscious consumers but also have the potential to tap into a growing market.

Investors are also recognizing that sustainable companies can provide substantial financial returns. A study by Harvard Business Review found that businesses with high social and environmental ratings had higher profitability and lower risk profiles. As more evidence emerges, we can expect investors to prioritize sustainability when evaluating companies.

However, sustainability goes beyond just environmental responsibility. Companies that focus on social issues and ethical practices also attract investors looking for a return on their investment while contributing to the greater good. As we look towards 2023, we expect this trend to continue gaining momentum in startup investing.

The impact of changing consumer behavior

Consumer behavior constantly evolves, and startups must keep up with these changes to stay ahead. In 2023, we can expect a greater emphasis on consumer-centric startups catering to customers' changing needs.

One significant change in consumer behavior is the shift towards conscious consumption. Consumers are increasingly mindful of their purchases' environmental and social impact, leading to a rise in ethical and sustainable consumerism. Startups that align with these values have the potential for significant growth and can attract investments from like-minded investors.

Another change is the growing popularity of digital products and services. The pandemic has accelerated this trend, with online shopping, virtual events, and telemedicine becoming the norm. Investors will likely invest in companies catering to this shift by providing innovative digital solutions.

However, the rise of conscious consumption and digitalization also pose challenges for startups. Companies must stay adaptable and quickly pivot their strategies to meet changing consumer demand. Investors will closely watch how startups handle these changes and make investment decisions accordingly.

The role of government policies in startup investing

Government policies play a significant role in shaping the startup investing landscape. We expect increasing government support and favorable startup policies, attracting more investors in 2023.

Governments worldwide have recognized the importance of startups in driving economic growth and creating jobs. As a result, we can expect to see more programs and initiatives to support startups, such as tax incentives, funding schemes, and streamlined regulations.

Another trend is the rise of impact investing, where investors seek to create a positive social or environmental impact with their investments. Governments are also promoting this type of investing through policies that incentivize companies to adopt sustainable business practices.

However, government policies can also pose challenges for startup investing. Changes in regulations and policies can affect a startup's operations and valuation, making investors wary. Therefore, investors must stay updated on government policies and their potential impact on startups. Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of New Orleans Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to New Orleans Sun.

More InformationBusiness

SectionBoeing links worker bonuses to company-wide performance

SEATTLE, Washington: Boeing has revamped its employee incentive plan, tying annual bonuses for more than 100,000 workers to overall...

US, Canadian farmers face rising fertilizer costs amid trade tensions

WINNIPEG, Manitoba: Farmers in the U.S. and Canada are bracing for soaring fertilizer prices as trade tensions escalate between the...

U.S. stocks stabilize after relentless losses

NEW YORK, New York - A slightly lower-than-expected CPI reading for February helped U.S. stocks to stabilize after some relentless...

New York office market rebounds as big investors hunt for deals

NEW YORK CITY, New York: New York's office market is showing signs of a comeback as major investors, including Blackstone, scout for...

Micro-wineries in Cyprus bring ancient Commandaria wine back to life

NICOSIA, Cyprus: Cyprus' ancient Commandaria wine, praised for its rich heritage dating back nearly 3,000 years, is making a comeback...

DoorDash, Williams-Sonoma, and others soar on S&P 500 inclusion

SAN FRANCISCO, California: Shares of DoorDash, Williams-Sonoma, Expand Energy, and TKO Group surged in extended trading on March 7...

International

SectionUS farmers face bankruptcy, economic uncertainty due to USDA freeze

CHICAGO/WASHINGTON, D.C.: Farmers and food groups across the U.S. are laying off workers, stopping investments, and struggling to get...

South Dakota law blocks eminent domain for carbon pipelines

SIOUX FALLS, South Dakota: A new South Dakota law banning the use of eminent domain for carbon capture pipelines has cast doubt on...

US intelligence agency orders DEIA officials to resign or face firing

WASHINGTON, D.C.: Officials working on diversity and inclusion programs at the U.S. Office of the Director of National Intelligence...

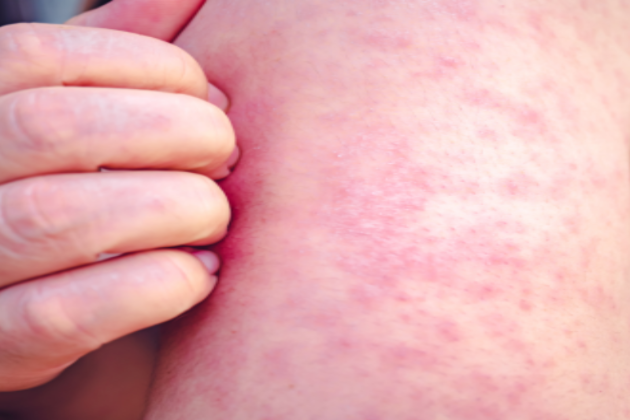

CDC study follows measles outbreak amid declining vaccination rates

WASHINGTON, D.C.: The U.S. Centers for Disease Control and Prevention (CDC) is planning an extensive study on possible links between...

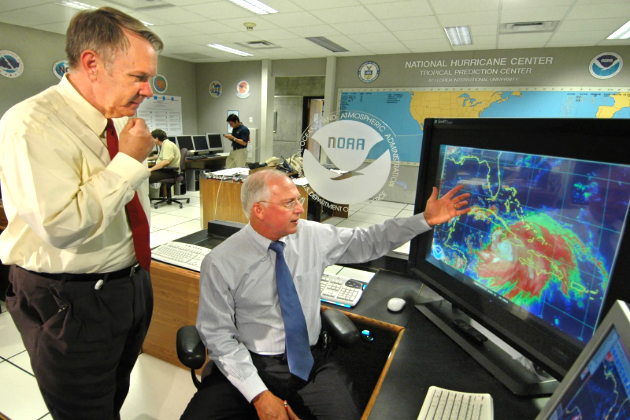

US weather agency faces big layoffs under Trump’s civil service cuts

WASHINGTON, D.C.: The U.S. weather agency, NOAA, plans to lay off 1,029 workers following 1,300 job cuts earlier this year. This...

New Mexico reports first measles-related death in over 40 years

SANTA FE: New Mexico: A New Mexico resident who died recently tested positive for measles, marking the state's first measles-related...